Van der Waals Heterostructure Device Engineering in 2025: Pioneering Next-Gen Electronics and Quantum Technologies. Explore How Layered Innovation is Shaping the Future of Nanoelectronics.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Technology Overview: Fundamentals of Van der Waals Heterostructures

- Recent Breakthroughs and Patent Activity (2023–2025)

- Key Players and Industry Collaborations (e.g., ibm.com, samsung.com, ieee.org)

- Market Size, Segmentation, and 2025–2030 CAGR Forecast (Est. 18–22% Growth)

- Emerging Applications: Quantum Computing, Optoelectronics, and Flexible Devices

- Manufacturing Challenges and Scalability Solutions

- Regulatory, Standardization, and Sustainability Initiatives (e.g., ieee.org)

- Investment Trends, Funding, and M&A Activity

- Future Outlook: Disruptive Potential and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

The market landscape for Van der Waals (vdW) heterostructure device engineering in 2025 is characterized by rapid advancements in material synthesis, device integration, and early-stage commercialization. Van der Waals heterostructures—engineered stacks of two-dimensional (2D) materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride—are enabling a new class of electronic and optoelectronic devices with unprecedented performance and tunability. The key drivers shaping this sector include the demand for next-generation transistors, photodetectors, flexible electronics, and quantum devices, as well as the ongoing miniaturization of semiconductor components.

In 2025, leading semiconductor manufacturers and material suppliers are intensifying their investments in scalable production methods for high-quality 2D materials. Companies such as Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) are actively exploring vdW heterostructures for advanced logic and memory applications, leveraging their expertise in wafer-scale integration and process innovation. Meanwhile, specialty material providers like 2D Semiconductors and Graphenea are expanding their portfolios to include a broader range of 2D crystals and heterostructure assemblies, supporting both R&D and pilot-scale device fabrication.

The sector is also witnessing increased collaboration between industry and academia, with consortia and research alliances focusing on overcoming challenges related to interface engineering, defect control, and large-area uniformity. For instance, the Interuniversity Microelectronics Centre (imec) is spearheading initiatives to integrate 2D materials into CMOS-compatible processes, aiming to bridge the gap between laboratory-scale demonstrations and industrial adoption.

Key market drivers in 2025 include the surging demand for energy-efficient, high-speed electronics, the proliferation of Internet of Things (IoT) devices, and the push for flexible and wearable technologies. The unique properties of vdW heterostructures—such as atomically sharp interfaces, tunable bandgaps, and strong light-matter interactions—position them as critical enablers for these applications. Additionally, the emergence of quantum information technologies is spurring interest in vdW-based quantum devices, with companies like IBM and Intel exploring their potential for quantum computing and sensing.

Looking ahead, the outlook for vdW heterostructure device engineering remains highly promising. As fabrication techniques mature and supply chains for 2D materials become more robust, the sector is expected to transition from prototyping to early commercialization across multiple verticals. Strategic partnerships, continued investment in R&D, and standardization efforts will be pivotal in unlocking the full potential of vdW heterostructures in the coming years.

Technology Overview: Fundamentals of Van der Waals Heterostructures

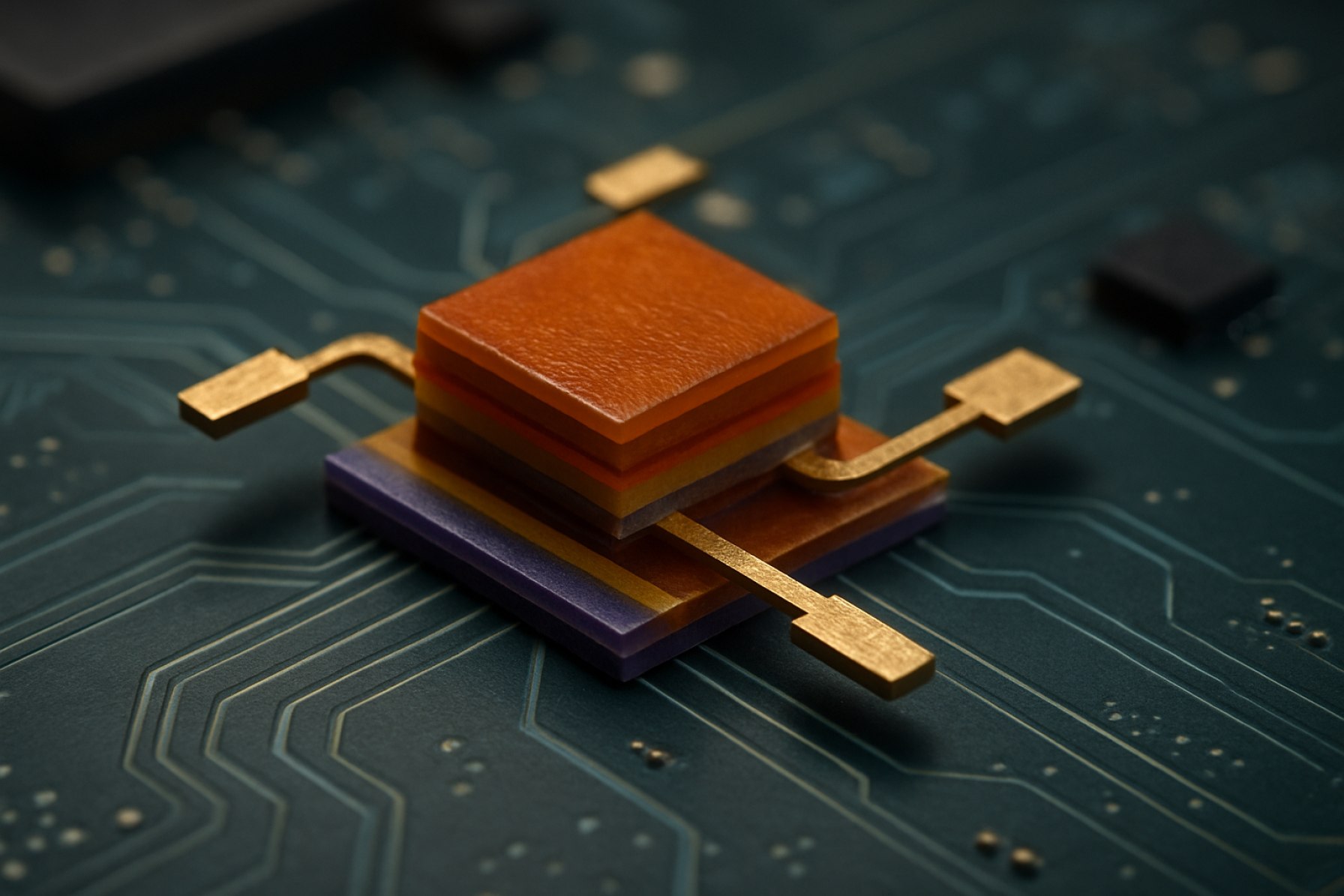

Van der Waals (vdW) heterostructure device engineering leverages the unique properties of two-dimensional (2D) materials, such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride (hBN), to create atomically precise interfaces without the constraints of lattice matching. This approach enables the stacking of dissimilar materials with clean, atomically sharp interfaces, leading to novel device architectures and functionalities that are unattainable with conventional bulk semiconductors.

The fundamental principle behind vdW heterostructures is the weak van der Waals force that holds the layers together, allowing for the assembly of materials with vastly different electronic, optical, and mechanical properties. Since 2018, the field has rapidly advanced, with 2025 seeing a surge in both academic and industrial interest. The ability to engineer band alignments, interlayer coupling, and moiré superlattices has enabled the demonstration of high-performance transistors, tunneling devices, photodetectors, and quantum devices.

Key to the progress in 2025 is the refinement of fabrication techniques. Mechanical exfoliation, while still used for prototyping, is being supplemented and gradually replaced by scalable methods such as chemical vapor deposition (CVD) and molecular beam epitaxy (MBE). Companies like Oxford Instruments and JEOL Ltd. are providing advanced deposition and characterization tools that support the controlled growth and analysis of 2D materials and their heterostructures. These tools are critical for achieving wafer-scale uniformity and reproducibility, which are prerequisites for commercial device integration.

Device engineering in vdW heterostructures is also benefiting from advances in transfer and alignment technologies. Automated stacking systems, such as those developed by Park Systems, enable precise rotational and translational alignment, which is essential for exploiting moiré physics and interlayer excitonic effects. Furthermore, companies like HORIBA are offering state-of-the-art spectroscopic and electrical measurement platforms tailored for 2D materials, facilitating rapid feedback during device fabrication and testing.

Looking ahead, the next few years are expected to witness the transition of vdW heterostructure devices from laboratory demonstrations to early-stage commercial applications. Target areas include low-power logic, neuromorphic computing, and highly sensitive photodetectors. The integration of vdW heterostructures with silicon CMOS platforms is a major focus, with collaborative efforts between industry and academia aiming to overcome challenges in scalability, interface engineering, and reliability. As the ecosystem matures, the role of equipment manufacturers and material suppliers will be pivotal in enabling the widespread adoption of vdW heterostructure device technologies.

Recent Breakthroughs and Patent Activity (2023–2025)

The period from 2023 to 2025 has witnessed significant advancements in van der Waals (vdW) heterostructure device engineering, driven by both academic research and industrial innovation. These heterostructures, which stack atomically thin layers of two-dimensional (2D) materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride (hBN), have enabled the creation of devices with unprecedented electronic, optoelectronic, and quantum properties.

A major breakthrough in this timeframe has been the scalable fabrication of high-quality vdW heterostructures. Companies like Oxford Instruments have developed advanced chemical vapor deposition (CVD) and transfer systems, enabling wafer-scale production of 2D materials and their integration into heterostructures with precise control over layer orientation and cleanliness. This has facilitated the transition from laboratory-scale demonstrations to pilot manufacturing lines, a crucial step for commercialization.

In terms of device innovation, the integration of vdW heterostructures into tunneling field-effect transistors (TFETs), photodetectors, and memory devices has accelerated. For instance, Samsung Electronics has reported progress in using TMD-based heterostructures for next-generation memory and logic devices, leveraging their atomically sharp interfaces and tunable band alignments. Similarly, Taiwan Semiconductor Manufacturing Company (TSMC) has explored the use of 2D material stacks for ultra-scaled transistors, aiming to overcome the limitations of traditional silicon-based scaling.

Patent activity in this sector has surged, with a notable increase in filings related to methods for synthesizing large-area heterostructures, device architectures exploiting moiré superlattices, and novel interconnect schemes. According to the World Intellectual Property Organization (WIPO), the number of international patent applications mentioning “van der Waals heterostructures” or “2D material stacking” has more than doubled between 2022 and 2024, reflecting the growing commercial interest and competitive landscape.

Looking ahead to the next few years, the outlook for vdW heterostructure device engineering remains highly promising. Industry leaders such as Applied Materials are investing in process equipment tailored for 2D material integration, while collaborative initiatives between manufacturers and research institutes are expected to accelerate the path toward mass production. The convergence of scalable synthesis, device innovation, and robust intellectual property portfolios positions vdW heterostructures as a foundational technology for future electronics, optoelectronics, and quantum information systems.

Key Players and Industry Collaborations (e.g., ibm.com, samsung.com, ieee.org)

The field of Van der Waals (vdW) heterostructure device engineering is rapidly advancing, with significant contributions from leading technology companies, semiconductor manufacturers, and global research organizations. As of 2025, the landscape is shaped by both established industry giants and innovative startups, all seeking to harness the unique properties of atomically thin materials for next-generation electronic and optoelectronic devices.

Among the most prominent players, IBM continues to invest heavily in two-dimensional (2D) materials research, leveraging its expertise in semiconductor fabrication and quantum computing. IBM’s collaborations with academic institutions and industry consortia have yielded breakthroughs in integrating vdW heterostructures with silicon-based platforms, aiming to overcome scaling limitations in traditional CMOS technology.

Samsung Electronics is another key driver, with its Advanced Institute of Technology focusing on the scalable synthesis and device integration of transition metal dichalcogenides (TMDs) and graphene. Samsung’s efforts are directed toward flexible electronics, high-mobility transistors, and ultra-sensitive photodetectors, with several patents filed in the last two years for vdW-based device architectures.

In the United States, Intel Corporation has initiated collaborative projects with national laboratories and universities to explore the potential of vdW heterostructures for low-power logic and memory devices. Intel’s roadmap includes pilot lines for 2D material integration, with the goal of demonstrating manufacturable processes by 2027.

On the research and standardization front, IEEE plays a pivotal role in fostering industry-wide collaboration. Through its conferences and working groups, IEEE has facilitated the development of guidelines for the characterization and reliability assessment of vdW heterostructure devices, which are critical for commercial adoption.

European initiatives are also gaining momentum, with companies like STMicroelectronics and consortia such as the Graphene Flagship driving collaborative research across academia and industry. These efforts are supported by the European Union’s Horizon Europe program, which funds pilot projects and infrastructure for 2D material device prototyping.

Looking ahead, the next few years are expected to see increased cross-sector partnerships, with foundries, material suppliers, and device manufacturers aligning to address challenges in large-area synthesis, interface engineering, and device reliability. The convergence of expertise from companies like IBM, Samsung, Intel, and STMicroelectronics, alongside global standardization efforts led by IEEE, positions the vdW heterostructure device sector for accelerated innovation and commercialization through 2025 and beyond.

Market Size, Segmentation, and 2025–2030 CAGR Forecast (Est. 18–22% Growth)

The global market for Van der Waals (vdW) heterostructure device engineering is poised for robust expansion, with an estimated compound annual growth rate (CAGR) of 18–22% from 2025 to 2030. This growth is driven by accelerating demand for next-generation electronics, optoelectronics, and quantum devices leveraging the unique properties of atomically thin, layered materials. The market size in 2025 is projected to reach approximately USD 1.2–1.5 billion, with significant contributions from both established semiconductor manufacturers and emerging startups specializing in two-dimensional (2D) materials integration.

Segmentation within the vdW heterostructure device market is primarily based on application domains, material types, and end-user industries. Key application segments include:

- Electronics: Field-effect transistors (FETs), logic circuits, and memory devices utilizing 2D materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride (hBN).

- Optoelectronics: Photodetectors, light-emitting diodes (LEDs), and solar cells exploiting the tunable bandgaps and high carrier mobility of vdW heterostructures.

- Quantum Devices: Single-photon emitters, quantum dots, and superconducting junctions for quantum computing and communication.

- Sensors: Highly sensitive biosensors and chemical sensors enabled by the large surface-to-volume ratio and customizable interfaces of 2D materials.

Material segmentation is dominated by graphene, TMDs (such as MoS2 and WS2), hBN, and emerging 2D materials like black phosphorus and MXenes. The end-user landscape includes semiconductor foundries, research institutions, consumer electronics manufacturers, and automotive and aerospace sectors seeking advanced sensor and photonic solutions.

Major industry players are investing heavily in scalable synthesis, transfer, and integration techniques for vdW heterostructures. Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) are actively exploring 2D material integration for next-generation logic and memory devices. IMEC, a leading R&D hub, is collaborating with global partners to develop wafer-scale fabrication processes for vdW heterostructures. Startups such as Paragraf are commercializing graphene-based electronic and sensor devices, while 2D Semiconductors supplies high-quality 2D crystals for research and prototyping.

Looking ahead, the market outlook remains highly positive, underpinned by ongoing advances in material quality, device architecture, and integration with existing semiconductor platforms. As pilot production lines transition to volume manufacturing and new applications emerge in quantum and flexible electronics, the vdW heterostructure device engineering sector is expected to sustain double-digit growth through 2030.

Emerging Applications: Quantum Computing, Optoelectronics, and Flexible Devices

Van der Waals (vdW) heterostructure device engineering is rapidly advancing, with 2025 poised to be a pivotal year for emerging applications in quantum computing, optoelectronics, and flexible electronics. These heterostructures, composed of atomically thin layers of two-dimensional (2D) materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride, are enabling device architectures previously unattainable with conventional bulk materials.

In quantum computing, vdW heterostructures are being explored for their potential to host robust qubits and facilitate novel quantum phenomena. The ability to precisely stack and align 2D materials allows for the engineering of moiré superlattices, which can exhibit correlated electron states and superconductivity. Companies like IBM and Microsoft are actively investigating 2D material-based quantum devices, aiming to leverage their tunable band structures and reduced disorder for scalable quantum processors. In 2025, research is expected to focus on improving coherence times and integrating vdW heterostructures with existing quantum hardware platforms.

Optoelectronics is another area where vdW heterostructures are making significant inroads. The atomically sharp interfaces and direct bandgaps of certain TMDs enable highly efficient light-matter interactions, making them ideal for next-generation photodetectors, light-emitting diodes (LEDs), and solar cells. Samsung Electronics and Toshiba Corporation are among the industry leaders developing prototype devices that exploit the unique excitonic properties of vdW heterostructures for ultrafast and low-power optoelectronic components. In 2025 and beyond, the focus will likely shift toward large-area synthesis and integration with silicon photonics, aiming for commercial viability in telecommunications and imaging.

Flexible and wearable electronics represent a third frontier for vdW heterostructure device engineering. The inherent flexibility and mechanical resilience of 2D materials make them well-suited for bendable displays, sensors, and energy storage devices. LG Electronics and Sony Group Corporation are investing in the development of flexible transistors and transparent electrodes based on vdW heterostructures, targeting applications in foldable smartphones and smart textiles. The next few years are expected to see advances in scalable roll-to-roll manufacturing and improved interlayer adhesion, addressing key challenges for mass production.

Overall, the outlook for vdW heterostructure device engineering in 2025 and the near future is marked by rapid progress toward commercialization, driven by collaborative efforts between leading technology companies and research institutions. As synthesis techniques mature and integration challenges are addressed, vdW heterostructures are set to play a transformative role across quantum computing, optoelectronics, and flexible device markets.

Manufacturing Challenges and Scalability Solutions

The manufacturing of van der Waals (vdW) heterostructure devices—where atomically thin layers of different two-dimensional (2D) materials are stacked with precise control—faces significant challenges as the field moves from laboratory-scale demonstrations to scalable, industrial production. In 2025, the primary hurdles include achieving wafer-scale uniformity, maintaining pristine interfaces, and integrating these materials with existing semiconductor processes.

One of the most persistent challenges is the synthesis of high-quality, large-area 2D materials. While mechanical exfoliation remains the gold standard for research, it is not scalable. Chemical vapor deposition (CVD) and metal-organic chemical vapor deposition (MOCVD) have emerged as leading techniques for growing monolayer and few-layer films of materials such as graphene, MoS2, and hBN. Companies like 2D Semiconductors and Graphenea are actively supplying CVD-grown 2D materials, with ongoing improvements in domain size and defect density. However, achieving uniformity and reproducibility across 6-inch or larger wafers remains a technical bottleneck.

Another critical issue is the deterministic stacking of different 2D layers without introducing contamination or misalignment. Automated transfer systems are being developed to address this, with companies such as Oxford Instruments offering advanced tools for dry transfer and encapsulation. These systems aim to minimize polymer residues and environmental exposure, which can degrade device performance. Nevertheless, the throughput and yield of such processes are still limited compared to conventional semiconductor manufacturing.

Integration with silicon-based platforms is also a major focus. Efforts are underway to develop hybrid process flows that allow vdW heterostructures to be incorporated into CMOS-compatible fabrication lines. Industry consortia and research alliances, including those involving TSMC and Samsung Electronics, are exploring pilot lines for 2D material integration, targeting applications in logic, memory, and sensing.

Looking ahead, the next few years are expected to see incremental advances in both materials synthesis and device assembly. The development of roll-to-roll CVD systems and in-situ characterization tools is anticipated to improve scalability and quality control. Standardization efforts, led by organizations such as Semiconductor Industry Association, are likely to accelerate the adoption of vdW heterostructure devices by establishing benchmarks for material quality and process compatibility. While full-scale commercial deployment remains a challenge, the convergence of materials science, automation, and semiconductor engineering is poised to bring vdW heterostructure device manufacturing closer to industrial reality by the late 2020s.

Regulatory, Standardization, and Sustainability Initiatives (e.g., ieee.org)

The regulatory, standardization, and sustainability landscape for Van der Waals (vdW) heterostructure device engineering is rapidly evolving as the field transitions from laboratory-scale research to early-stage commercialization. In 2025, the focus is on establishing robust frameworks to ensure device reliability, interoperability, and environmental responsibility, particularly as vdW heterostructures—composed of atomically thin layers such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride—move toward integration in next-generation electronics, optoelectronics, and quantum devices.

Standardization efforts are being spearheaded by international bodies such as the IEEE, which is actively developing guidelines for the characterization, measurement, and reporting of 2D materials and their heterostructures. The IEEE’s Nanotechnology Council and related working groups are collaborating with academic and industrial stakeholders to define protocols for material quality, device performance metrics, and reliability testing. These standards are critical for ensuring reproducibility and comparability across research groups and manufacturers, and are expected to be formalized and adopted more widely over the next few years.

On the regulatory front, agencies in the United States, European Union, and Asia are beginning to address the unique challenges posed by vdW heterostructures, particularly regarding material safety, supply chain transparency, and end-of-life management. For example, the European Chemicals Agency (ECHA) is monitoring the use of nanomaterials, including 2D materials, under the REACH regulation, with ongoing consultations on risk assessment and labeling requirements. In parallel, the U.S. Environmental Protection Agency (EPA) is evaluating the environmental and health impacts of nanomaterial manufacturing and disposal, with a focus on lifecycle analysis and potential restrictions for hazardous substances.

Sustainability initiatives are gaining momentum as industry leaders recognize the importance of responsible sourcing and manufacturing. Companies such as Oxford Instruments and JEOL Ltd., both major suppliers of 2D material synthesis and characterization equipment, are increasingly emphasizing green chemistry approaches, energy-efficient processing, and recycling of process chemicals. These efforts are complemented by collaborative projects between industry and academia to develop scalable, low-impact production methods for vdW heterostructures, such as chemical vapor deposition (CVD) using less toxic precursors and solvent-free transfer techniques.

Looking ahead, the next few years will likely see the formalization of international standards, the introduction of new regulatory requirements for nanomaterial-based devices, and the expansion of sustainability certifications specific to 2D materials. These developments are expected to facilitate broader adoption of vdW heterostructure devices in commercial applications, while ensuring safety, reliability, and environmental stewardship across the value chain.

Investment Trends, Funding, and M&A Activity

The investment landscape for van der Waals (vdW) heterostructure device engineering has experienced notable momentum entering 2025, driven by the convergence of advanced materials research, semiconductor industry demand, and the promise of next-generation electronics. Venture capital and corporate funding have increasingly targeted startups and scale-ups specializing in two-dimensional (2D) materials integration, with a particular focus on applications in transistors, photodetectors, and quantum devices.

Key players in the semiconductor and materials sectors, such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and Intel Corporation, have publicly disclosed research initiatives and collaborative projects exploring vdW heterostructures for sub-5nm logic and memory devices. These companies are not only investing internally but also engaging in strategic partnerships with academic institutions and emerging technology firms to accelerate the commercialization of 2D material-based devices.

In 2024 and early 2025, several early-stage companies specializing in vdW heterostructure fabrication and device prototyping have secured significant seed and Series A funding rounds. For example, startups focusing on scalable chemical vapor deposition (CVD) and transfer techniques for 2D materials have attracted investment from both corporate venture arms and dedicated deep-tech funds. Notably, Applied Materials and Lam Research—leading suppliers of semiconductor manufacturing equipment—have expanded their investment portfolios to include companies developing vdW stacking and integration tools, signaling a recognition of the technology’s potential impact on future process nodes.

Mergers and acquisitions (M&A) activity, while still nascent compared to mature semiconductor segments, has begun to emerge. In late 2024, a notable acquisition involved a European materials startup with proprietary vdW assembly technology being acquired by a major Asian foundry, aiming to secure intellectual property and accelerate pilot line deployment. Such moves reflect a broader trend of established industry players seeking to vertically integrate critical vdW capabilities and reduce time-to-market for advanced device architectures.

Looking ahead to the next few years, the outlook for investment and M&A in vdW heterostructure device engineering remains robust. As pilot production lines transition to early commercial deployment—particularly in logic, memory, and optoelectronic applications—analysts anticipate increased capital inflows, further strategic alliances, and a gradual uptick in acquisition activity. The sector’s trajectory will be shaped by the pace of technical milestones, supply chain maturation, and the ability of startups to demonstrate scalable, reliable manufacturing processes that meet the stringent requirements of leading semiconductor manufacturers.

Future Outlook: Disruptive Potential and Strategic Recommendations

Van der Waals (vdW) heterostructure device engineering is poised to disrupt multiple sectors in the coming years, leveraging the unique properties of two-dimensional (2D) materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride. As of 2025, the field is transitioning from fundamental research to early-stage commercialization, with significant investments and pilot-scale manufacturing underway. The ability to stack atomically thin layers with precise control enables the creation of bespoke electronic, optoelectronic, and quantum devices with performance characteristics unattainable by conventional semiconductor technologies.

Key industry players are accelerating the development of scalable synthesis and transfer techniques. Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) have both announced research initiatives targeting vdW heterostructures for next-generation transistors and memory devices, aiming to overcome the scaling limitations of silicon-based CMOS. IBM is also actively exploring 2D material integration for logic and neuromorphic computing, with a focus on energy efficiency and device miniaturization.

In the optoelectronics domain, Novaled and OSRAM are investigating vdW heterostructures for ultra-thin, flexible photodetectors and light-emitting devices, targeting applications in wearable electronics and advanced displays. Meanwhile, Oxford Instruments and JEOL Ltd. are supplying advanced deposition and characterization tools, enabling reproducible fabrication and quality control at the atomic scale.

Looking ahead, the disruptive potential of vdW heterostructure devices lies in their ability to enable entirely new device architectures. For example, vertical tunneling transistors, single-photon emitters, and room-temperature quantum devices are all within reach, promising breakthroughs in quantum computing, secure communications, and high-performance sensing. The next few years will likely see the first commercial prototypes in niche markets, such as quantum photonics and flexible electronics, with broader adoption contingent on further advances in wafer-scale synthesis, defect control, and integration with existing semiconductor processes.

Strategically, companies and research institutions should prioritize partnerships to bridge the gap between laboratory-scale demonstrations and industrial-scale manufacturing. Investment in standardization, supply chain development, and workforce training will be critical to realize the full potential of vdW heterostructure device engineering. As the ecosystem matures, early movers with robust intellectual property and scalable processes are well-positioned to capture significant value in the emerging 2D materials market.

Sources & References

- 2D Semiconductors

- Interuniversity Microelectronics Centre (imec)

- IBM

- Oxford Instruments

- JEOL Ltd.

- HORIBA

- World Intellectual Property Organization (WIPO)

- IEEE

- STMicroelectronics

- Paragraf

- IBM

- Microsoft

- LG Electronics

- Semiconductor Industry Association

- Oxford Instruments

- Novaled

- OSRAM