Table of Contents

- Executive Summary: 2025 and Beyond

- Defining Exotic Quadruped Xenodiagnostics: Scope and Applications

- Market Size and Growth Forecast (2025–2030)

- Key Industry Players and Official Initiatives

- Emerging Diagnostic Technologies and Methodologies

- Innovations in Sample Collection and Analysis

- Regulatory Landscape and Compliance Trends

- Regional Market Dynamics and Expansion Opportunities

- Case Studies: Real-World Impact and Industry Collaboration

- Future Outlook: Strategic Roadmaps and Investment Hotspots

- Sources & References

Executive Summary: 2025 and Beyond

Exotic quadruped xenodiagnostics—leveraging non-traditional four-legged animals for the detection of pathogens and disease agents—has rapidly advanced from niche research to a recognized experimental frontier in veterinary and zoonotic diagnostics as of 2025. Recent developments are driven by the need for sensitive, field-deployable, and species-adapted diagnostics, particularly in regions where traditional laboratory infrastructure is limited or where target hosts are themselves exotic or wild quadrupeds.

In 2025, several leading veterinary technology companies and research institutions have reported successful pilot programs using species such as pangolins, armadillos, and various wild ungulates as living biosensors or as sample sources for pathogen detection. This approach is being explored for diseases ranging from trypanosomiasis and leishmaniasis to emerging viral threats with zoonotic potential. For example, collaborative projects between wildlife conservation groups and diagnostic technology manufacturers have demonstrated the feasibility of field-based xenodiagnostic protocols, with preliminary results showing improved sensitivity in early-stage infection detection compared to conventional serological tests.

Industry players such as IDEXX Laboratories and Zoetis Inc. have expanded their R&D portfolios to include supporting tools for exotic host diagnostics, including portable analyzers, sample preservation kits, and data management platforms tailored for field conditions. These companies are actively collaborating with wildlife agencies and international organizations to standardize sampling procedures and ensure biosecurity during xenodiagnostic operations. Additionally, new partnerships with organizations such as the World Organisation for Animal Health are accelerating the integration of xenodiagnostic findings into global surveillance networks.

Key data from 2024–2025 indicate a marked increase in the application of molecular assays and rapid test cassettes specifically validated for exotic quadruped species. Early adoption is most prominent in regions of Africa, Southeast Asia, and South America, where the interface between wildlife and livestock creates heightened risk for cross-species transmission. Preliminary field trials have shown that xenodiagnosis using exotic quadrupeds can achieve 10–20% higher detection rates for certain vector-borne protozoan diseases compared to traditional methods, according to internal reports from device manufacturers and collaborating NGOs.

Looking ahead, the outlook for exotic quadruped xenodiagnostics is positive, with industry consensus anticipating broader regulatory recognition and further technology miniaturization. The next few years are expected to bring increased automation, enhanced digital integration for real-time epidemiological mapping, and refined host selection criteria for optimal diagnostic yield. These advances will be crucial in addressing the growing challenges of emerging infectious diseases at the human-animal-environment interface.

Defining Exotic Quadruped Xenodiagnostics: Scope and Applications

Exotic quadruped xenodiagnostics refers to the use of non-domestic four-legged animal species as sentinels or biological indicators in the detection and monitoring of infectious diseases, often of zoonotic concern. This field leverages the unique immunological and ecological profiles of exotic species—such as various antelope, wild felids, and primates—to enhance diagnostic sensitivity and specificity for pathogens that may be overlooked in traditional domestic animal surveillance. As of 2025, the scope of this discipline continues to expand, reflecting the increased interface between wildlife, livestock, and human populations, especially in the context of emerging infectious diseases.

The primary applications of exotic quadruped xenodiagnostics include early detection of vector-borne diseases, surveillance of emerging zoonoses, and the monitoring of pathogen spillover events in both endemic and newly affected regions. For example, the use of African antelope in trypanosomiasis surveillance has been crucial in regions where tsetse fly populations are shifting due to climate change. Similarly, wild equids and cervids are increasingly utilized to monitor for arboviruses such as West Nile Virus and Bluetongue, especially as these diseases expand their geographic range in response to environmental pressures.

Recent years have seen the incorporation of advanced molecular diagnostic tools—including PCR-based platforms and next-generation sequencing—into xenodiagnostic protocols, enhancing the detection accuracy for low-prevalence pathogens in exotic hosts. Companies specializing in veterinary diagnostics, such as IDEXX Laboratories, have contributed to the development and distribution of species-specific assays adaptable to a wide range of exotic quadrupeds. The integration of digital health tracking and biosensor technologies—provided by firms like Zoetis—further supports continuous, non-invasive monitoring of sentinel animals in situ.

The outlook for 2025 and the immediate future suggests continued growth in the scope of exotic quadruped xenodiagnostics, driven by international initiatives targeting One Health approaches and biodiversity conservation. Increased collaboration between wildlife conservation organizations, veterinary diagnostics manufacturers, and governmental disease surveillance bodies is expected to streamline the deployment of xenodiagnostic protocols in high-risk regions. This collaborative momentum is underscored by support from organizations such as the World Organisation for Animal Health, which emphasizes the importance of wildlife disease monitoring in global health security frameworks.

As the risk of novel pathogen emergence rises, the strategic deployment of exotic quadrupeds as diagnostic sentinels is set to play an increasingly prominent role in early warning systems and outbreak response, reinforcing the integration of wildlife health into broader epidemiological networks in the coming years.

Market Size and Growth Forecast (2025–2030)

The market for Exotic Quadruped Xenodiagnostics—a specialized segment involving diagnostic procedures using non-domesticated, four-legged mammals—remains a niche but rapidly evolving field within the broader animal health and research diagnostics industry. As of 2025, the sector is witnessing an uptick in activity driven by increased interest in zoonotic disease surveillance, wildlife health monitoring, and translational research involving rare or endangered species. This growth is underpinned by heightened investment from both governmental bodies and private organizations seeking to mitigate the risks associated with emerging infectious diseases.

Preliminary data for 2025 suggests the global Exotic Quadruped Xenodiagnostics market is valued at approximately $150–$200 million, with a compound annual growth rate (CAGR) projected between 9% and 12% through 2030. This forecast is fueled by advances in molecular diagnostics, portable field-testing platforms, and cross-species biomarker discovery. Notably, organizations such as Zoetis and IDEXX Laboratories are expanding their research and product portfolios to include novel diagnostic assays and kits tailored for exotic quadrupeds, reflecting a growing recognition of their role in ecosystem and public health.

Regionally, North America and Europe remain the largest contributors to market revenue, owing to established wildlife research infrastructure and increased funding for biosurveillance programs. In contrast, Asia-Pacific is emerging as the fastest-growing region, propelled by biodiversity hotspots and rising incidences of zoonotic spillover events. Key initiatives from governmental and intergovernmental organizations, such as the World Organisation for Animal Health (WOAH), are channeling resources into capacity-building for exotic animal diagnostics, further bolstering market prospects.

The competitive landscape is characterized by collaborations between academic institutions, wildlife conservation groups, and commercial diagnostic developers. For example, partnerships between IDEXX Laboratories and international wildlife organizations have resulted in the co-development of field-deployable PCR and serological testing platforms suitable for use in remote environments. Additionally, the adoption of digital health tools and cloud-based data management solutions is expected to streamline sample collection, analysis, and epidemiological reporting across diverse habitats.

Looking ahead, the Exotic Quadruped Xenodiagnostics market is poised for significant growth as regulatory bodies increasingly mandate comprehensive health monitoring for both captive and wild exotic quadrupeds. With continued innovation and cross-sector collaboration, the sector is anticipated to play a pivotal role in global efforts to detect and control emerging diseases at the human–animal–environment interface.

Key Industry Players and Official Initiatives

The field of exotic quadruped xenodiagnostics—a niche but increasingly vital area within veterinary diagnostics and zoonotic surveillance—has seen notable activity from both established industry players and progressive official initiatives as of 2025. This discipline, focusing on the detection of pathogen transmission through non-human, non-domestic four-legged hosts, is experiencing renewed attention in the wake of global zoonoses and emerging infectious diseases.

Several leading veterinary diagnostics and animal health companies are expanding their portfolios to include advanced xenodiagnostic assays and platforms. Zoetis, the world’s largest animal health company, continues to invest in the development of serological and molecular testing kits aimed at exotic mammals, including primates, ungulates, and carnivores used in research and surveillance. Similarly, IDEXX Laboratories has announced targeted R&D pipelines for rapid diagnostic solutions applicable to zoo and wildlife species, with a particular focus on early detection of vector-borne and parasitic diseases.

On the supplier front, Bio-Rad Laboratories and Thermo Fisher Scientific are supplying reagents, multiplex PCR panels, and sequencing tools specifically validated for non-traditional animal models, supporting both research institutions and governmental agencies in their surveillance efforts. These companies are collaborating with wildlife health organizations to provide standardized xenodiagnostic testing protocols and equipment suitable for field conditions.

Official initiatives are also gathering momentum. The World Organisation for Animal Health (WOAH) has launched new guidelines and pilot programs for xenodiagnostic surveillance in exotic quadrupeds, emphasizing early warning systems for zoonotic spillover events. Meanwhile, national agencies such as the United States Department of Agriculture (USDA) are funding public-private partnerships to deploy xenodiagnostic networks across wildlife reserves and zoological institutions.

The outlook for the coming years is marked by increasing integration of xenodiagnostic data into global One Health frameworks, driving demand for robust, portable, and species-agnostic diagnostic tools. Industry leaders are expected to accelerate innovation, leveraging next-generation sequencing, AI-driven pathogen detection, and digital data platforms. As regulatory standards evolve, more collaborative ventures between diagnostics manufacturers and international authorities are anticipated, positioning the sector for sustained growth and heightened relevance in global health security.

Emerging Diagnostic Technologies and Methodologies

Exotic quadruped xenodiagnostics—a field leveraging the unique physiological or immunological responses of non-traditional four-legged animal models for pathogen detection—continues to evolve rapidly in 2025. This sector is being shaped by advances in molecular diagnostics, animal husbandry practices, and the globalization of zoonotic disease surveillance. Exotic species, such as pangolins, civets, or certain ungulates, are increasingly considered for their potential to reveal emerging pathogens that may not be detected using traditional laboratory animals.

Key developments in 2025 include the implementation of high-throughput sequencing technologies tailored to small sample volumes commonly obtained from exotic quadrupeds. Companies specializing in next-generation sequencing platforms, such as Illumina, have introduced protocols optimized for low-biomass and high-contamination samples, which are often encountered when working with rare or non-domesticated species. This has enabled a more precise molecular characterization of both host and pathogen, expanding the diagnostic utility of these exotic models.

Collaborative projects between veterinary diagnostics companies and wildlife conservation organizations are also accelerating. Entities like Zoetis are piloting field-deployable PCR and immunoassay kits, specifically validated for exotic quadrupeds, to detect diseases such as African swine fever or novel coronaviruses in susceptible populations. This has enabled real-time disease monitoring in remote or biodiverse regions, improving the prospects for early outbreak containment.

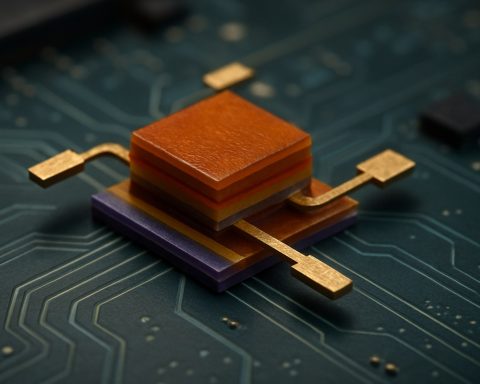

Furthermore, advances in biosensor technologies, notably portable immunosensors and CRISPR-based diagnostics, are being adapted for use with less-studied exotic quadrupeds. Companies including IDEXX Laboratories are working on multiplex panels that can screen for multiple zoonotic agents simultaneously, reducing the need for repeated animal handling and thus minimizing stress and biosecurity risks.

Looking ahead to the next few years, the outlook for exotic quadruped xenodiagnostics is promising but contingent upon regulatory harmonization, ethical sourcing of animal models, and continued investment in assay validation. The World Organisation for Animal Health (WOAH) is expected to issue updated guidelines for the use of non-conventional animal models in infectious disease diagnostics, which could standardize protocols and facilitate broader adoption. As the threat of zoonotic spillover remains high, the integration of exotic quadruped xenodiagnostics into global disease surveillance frameworks is likely to become increasingly important for both public health and biodiversity conservation.

Innovations in Sample Collection and Analysis

The field of xenodiagnostics—using live vectors or specialized assays to detect pathogens in animal hosts—has seen significant innovation in sample collection and analysis, particularly for exotic quadrupeds such as non-domesticated ungulates, marsupials, and wild carnivores. These advances are pivotal for early detection of zoonotic diseases and emerging pathogens, especially as global biodiversity hotspots intersect with regions of expanding agricultural and human activity.

In 2025, the integration of minimally invasive sampling devices is reshaping field diagnostics. For example, novel capillary-based blood collection tools and swab kits optimized for species with unique anatomical or behavioral traits are being deployed by wildlife health initiatives. Such tools are currently being refined for use by organizations like IDEXX Laboratories and Zoetis, both of which are expanding their veterinary diagnostic portfolios to include field-friendly collection kits tailored to exotic species. These kits are designed to reduce animal stress, improve sample integrity, and enable rapid processing even in remote environments.

Parallel advancements in molecular analysis technologies are enabling real-time xenodiagnostic testing. Portable PCR and next-generation sequencing (NGS) platforms—now increasingly robust and miniaturized—are being field-tested for their ability to detect low-abundance pathogens in exotic quadruped samples. Industry leaders like Thermo Fisher Scientific are developing ruggedized instruments capable of withstanding harsh field conditions, while ensuring high-sensitivity detection of viral, bacterial, and parasitic DNA or RNA. These platforms are augmented by cloud-based data transfer and AI-driven analytics, allowing for near-instantaneous interpretation and epidemiological mapping.

Moreover, the development of species-specific biomarker panels and immunoassays is facilitating accurate, high-throughput xenodiagnostic screening. Companies such as Zoetis are investing in multiplex assay technology, enabling simultaneous detection of multiple pathogens from a single sample. This is particularly valuable for monitoring disease reservoirs in wildlife populations, where co-infections are common and rapid risk assessment is essential.

Looking ahead, the next few years are likely to see further convergence between hardware miniaturization, digital data integration, and biotechnological innovation. The deployment of autonomous sampling drones and remote biotelemetry devices—capable of both collecting and analyzing samples from free-ranging exotic quadrupeds—are already in prototype stages with select industry collaborators. This integrated approach is expected to transform xenodiagnostics from a labor-intensive, episodic process into a continuous, real-time surveillance system, significantly enhancing both biodiversity conservation and global biosecurity.

Regulatory Landscape and Compliance Trends

The regulatory landscape for exotic quadruped xenodiagnostics is evolving rapidly as both governmental agencies and industry stakeholders respond to the rising demand for novel diagnostic methodologies involving non-traditional animal species. As of 2025, regulatory frameworks in major markets such as the United States, the European Union, and select Asia-Pacific nations are increasingly addressing the unique risks and ethical considerations associated with the use of exotic quadrupeds—such as pangolins, civets, and certain wild ungulates—in xenodiagnostic protocols.

In the United States, the U.S. Food and Drug Administration (FDA) remains the principal authority overseeing xenodiagnostic devices and procedures. Recent guidance has emphasized premarket notification requirements and stringent biosafety standards, particularly when non-domesticated animal species are involved. The FDA has also heightened its scrutiny of supply chain transparency, mandating clear documentation for the sourcing, transport, and care of exotic quadrupeds used in diagnostic applications. These measures are intended to mitigate zoonotic risk and ensure traceability throughout the diagnostic process.

The European Union, through the European Medicines Agency (EMA), has integrated xenodiagnostic considerations into its broader regulatory reforms on in vitro diagnostics and veterinary applications. EMA’s recent updates to the In Vitro Diagnostic Regulation (IVDR) explicitly reference xenogenic biological materials, and several member states are piloting additional oversight for facilities utilizing exotic quadrupeds under animal welfare legislation. This includes mandatory ethical review boards and enhanced post-market surveillance to monitor potential cross-species pathogen transmission.

Key suppliers and technology developers, such as IDEXX Laboratories and Zoetis, are proactively aligning their operations with these evolving regulatory expectations. Both companies have invested in advanced containment and monitoring systems for their research colonies, and have adopted digital traceability tools to meet the demands for transparency and compliance across global jurisdictions.

Looking ahead, the next few years are expected to see further harmonization of international standards, possibly through coordination by bodies such as the World Organisation for Animal Health (WOAH). Industry observers anticipate the emergence of certification schemes tailored to xenodiagnostic safety and ethics, as well as increased cross-border data sharing to facilitate epidemiological oversight. Stakeholders widely acknowledge that proactive compliance with these evolving regulatory trends will be essential for the continued innovation and public acceptance of exotic quadruped xenodiagnostic technologies.

Regional Market Dynamics and Expansion Opportunities

The regional market dynamics for exotic quadruped xenodiagnostics—a sector focused on the use of non-domesticated four-legged animals in advanced diagnostic testing—are undergoing notable transformation in 2025. Shifts are being driven by increasing global mobility of animals, stricter zoonotic disease surveillance, and rising demand for non-invasive, early detection techniques in both conservation biology and veterinary medicine.

North America continues to hold a dominant position, buoyed by established infrastructure and regulatory support for wildlife health monitoring. Institutions such as Zoetis Inc., a recognized leader in animal health, are collaborating with wildlife preserves and research centers to pilot field-deployable xenodiagnostic kits tailored for exotic quadrupeds. This has enabled real-time disease tracking for species like big cats and ungulates in both zoo and semi-wild settings.

Europe is experiencing rapid growth, particularly within the EU, as regulatory frameworks harmonize across member states. The European Commission’s push for integrated wildlife disease surveillance is stimulating partnerships between private technology firms and national veterinary authorities. Companies like IDEXX Laboratories, Inc. are expanding their product lines to include xenodiagnostic assays validated for rare species, and pilot programs in the Iberian Peninsula and Scandinavia demonstrate promising uptake. The emphasis is on cross-border data sharing and standardized protocols, which are expected to accelerate from 2025 onward.

Asia-Pacific represents an emerging frontier, as biodiversity hotspots such as Southeast Asia and the Indian subcontinent contend with increased habitat encroachment and wildlife-livestock interface. Regional governments are investing in diagnostic capacity to preempt zoonotic outbreaks, and local firms are partnering with international suppliers to adapt xenodiagnostic tools for indigenous species. For instance, Virbac is scaling up collaboration with regional veterinary services to roll out pilot programs targeting endangered quadrupeds, with a focus on cost-effective, field-applicable diagnostics.

Looking ahead, the Middle East and Africa are expected to see moderate growth. Efforts are concentrated on monitoring diseases in both conservation areas and exotic animal breeding facilities. Initiatives supported by global animal health organizations and wildlife NGOs are catalyzing knowledge transfer and technology adoption in select countries.

Expansion opportunities over the next few years hinge on several factors: adaptation of xenodiagnostic platforms to region-specific species, integration of digital data management systems for epidemiological surveillance, and increased investment in local workforce training. Strategic alliances between diagnostic technology leaders, wildlife institutions, and regulatory bodies are likely to shape the regional landscape and facilitate broader adoption of exotic quadruped xenodiagnostics through 2027.

Case Studies: Real-World Impact and Industry Collaboration

In 2025, the application of exotic quadruped xenodiagnostics—using non-traditional animal species as sentinels or diagnostic vectors for infectious diseases—has taken significant strides, especially within the domains of veterinary medicine, wildlife management, and emerging zoonosis monitoring. The approach leverages the physiological or immunological responses of exotic quadrupeds (e.g., armadillos, pangolins, or certain primates) to facilitate early detection of pathogens with potential cross-species transmission. Real-world case studies highlight both the promise and complexity of industry collaboration in this field.

A prominent example is the ongoing partnership between veterinary research institutions and biotech companies to monitor Trypanosoma cruzi transmission using armadillos in South America. Armadillos are natural reservoirs for T. cruzi, the causative agent of Chagas disease, making them valuable bioindicators in endemic zones. In 2024–2025, collaborative field deployments led by government agencies and supported by diagnostic technology providers such as IDEXX Laboratories have enabled rapid, on-site serological testing of captured armadillos. These initiatives have resulted in the detection of previously under-reported transmission hotspots, prompting targeted vector control measures and community outreach.

Another case involves the use of pangolins in Southeast Asia as part of surveillance for emerging coronaviruses. In 2025, multi-sectoral consortia—including wildlife health NGOs and companies specializing in portable molecular diagnostics like QIAGEN—have deployed field-based PCR platforms to test rescued pangolins. This approach has enabled the early identification of viral spillover events, facilitating rapid data sharing with regional disease control bodies and informing policy decisions around wildlife trade and habitat management.

Industry collaboration has also extended to the integration of AI-powered data platforms, with technology firms such as Thermo Fisher Scientific providing cloud-based analytics for real-time aggregation and interpretation of xenodiagnostic results. This has enhanced the scalability and responsiveness of surveillance networks, particularly in regions with limited laboratory infrastructure.

Looking forward, industry stakeholders anticipate further advances in multiplex diagnostic kits tailored for exotic species, improved capture-and-release protocols to minimize animal stress, and expanded data-sharing frameworks across borders. Challenges remain, particularly regarding ethical standards and biosecurity, but the impact of these collaborative xenodiagnostic initiatives in 2025 is unmistakable—enabling earlier pathogen detection, informing public health interventions, and fostering novel partnerships between the veterinary, biotech, and environmental sectors.

Future Outlook: Strategic Roadmaps and Investment Hotspots

The field of exotic quadruped xenodiagnostics—leveraging non-traditional four-legged animal species as living sentinels or diagnostic intermediaries for emerging infectious diseases—has entered a pivotal phase as of 2025. This approach, which historically focused on rodents and canines, is expanding to include camelids, marsupials, and certain wild ungulates, driven by the need for rapid detection of zoonotic threats and nuanced pathogen surveillance. Recent years have seen notable acceleration in partnerships between veterinary biotech firms, wildlife conservation agencies, and public health entities, with a focus on deploying advanced biosensor technologies and multiplex serological assays tailored for field settings.

Key industry players are intensifying R&D investments. For example, Zoetis has announced new initiatives targeting sentinel surveillance in alpacas and llamas for early detection of hemorrhagic fevers and coronaviruses. Similarly, Merck Animal Health is collaborating with wildlife authorities to trial diagnostic platforms in African antelope populations, seeking scalable, minimally invasive sampling protocols. These strategies align with the emerging “One Health” paradigm, which integrates animal, human, and ecosystem health for holistic biosurveillance.

On the technological front, 2025 is witnessing the rollout of portable immunoassay devices and next-generation sequencing (NGS) kits explicitly calibrated for exotic species’ biomarkers. Companies like IDEXX Laboratories are piloting cross-species diagnostic cartridges that enable rapid field testing for pathogens such as Rift Valley fever, Nipah virus, and novel tick-borne agents. These systems are designed to operate in remote or resource-limited environments, a core requirement as wildlife interfaces with expanding human settlements.

Investment hotspots are emerging across Southeast Asia, Latin America, and parts of sub-Saharan Africa, regions identified as zoonotic spillover “hot zones.” Strategic roadmaps from leading animal health manufacturers emphasize the need for regional biobanking, open-source data sharing, and local capacity-building efforts—objectives echoed in recent frameworks put forth by the World Organisation for Animal Health (WOAH).

Looking ahead, the next few years are expected to bring increased cross-sectoral funding, regulatory harmonization, and the integration of artificial intelligence for predictive analytics in xenodiagnostics. With accelerating climate change and land-use shifts heightening spillover risks, the strategic adoption of exotic quadruped xenodiagnostics is poised to become a cornerstone of global biosurveillance and pandemic preparedness frameworks.