- Pi Network faces volatility, with its price falling 22% over the past month and 17% in one day, trading at $1.16.

- The recent Know Your Customer (KYC) deadline has caused uncertainty, leading to a sell-off as unverified miners surrendered their tokens.

- Speculation surrounds a potential Binance listing, but the silence from Binance has increased investor skepticism.

- Pi Network’s unclear communication on its Open Mainnet launch fuels community frustration.

- Despite challenges, Pi Network sees growing real-world adoption in areas like China, boosting its utility as a payment mechanism.

- Stabilizing above $1.50 is crucial to regain trust and potentially achieve price gains towards $1.82.

- Failure to stabilize may see prices drop below $1.20, a low not reached since February.

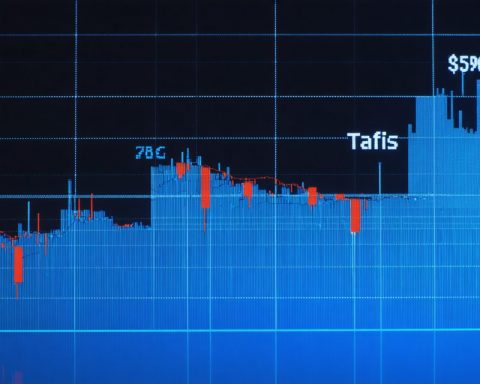

Cryptocurrency enthusiasts are eyeing Pi Network with a mix of hope and anxiety as the digital token grapples with a turbulent market. The network, once hailed as a trailblazer in the crowded crypto sphere, has seen its value tumble, shedding 22% over the past month and plummeting 17% in a single day. Trading at a poignant $1.16, Pi’s decline starkly contrasts its record market capitalization peak of $19.2 billion earlier this year.

Exacerbating the downturn is the looming deadline for Know Your Customer (KYC) verification, which has sent waves of uncertainty through the Pi community. As the deadline passed, miners unable to complete the verification surrendered their tokens, unsettling market confidence and prompting sharp sell-offs. With technical indicators revealing growing selling pressure and the DMI chart underscoring sellers’ dominance, market watchers are on high alert for potential further dips.

Market speculation has intensified amid whispers of a potential Binance listing, though silence from the exchange giant has only deepened investor skepticism. In a space where strategic listings can catapult a cryptocurrency to new heights, this silence speaks volumes.

Further fueling concerns is the Pi Network’s indistinct communication regarding its Open Mainnet launch. Despite persistent calls from a loyal community for clarity and strategic vision, the network’s core team has yet to deliver a defined path forward. This lack of transparency stands in stark contrast to other crypto projects known for their clear timelines and developments.

Despite these headwinds, Pi finds a silver lining in its growing real-world adoption, especially in China. From bustling restaurant scenes to retail venues, businesses are embracing PI tokens as legitimate currency, attesting to its evolving utility as a decentralized payment mechanism.

The path forward for Pi Network hinges on its ability to regain investor trust and stabilize its price above the symbolic $1.50 level. If the network can muster a rally, breaking through resistance could set the stage for gains toward $1.82 and beyond. Conversely, persistent bearish trends threaten to drag the price below critical supports, nudging it under $1.20—a precarious position not seen since February.

As the crypto community watches closely, Pi Network stands at a crossroads. The market’s next move will depend heavily on the network’s strategies and whether it can deliver on the promises made to its steadfast supporters. In this high-stakes environment, action—or the lack thereof—from Pi’s core team could define its future trajectory.

Pi Network: Navigating Uncertainty Amid Market Volatility

Understanding Pi Network’s Current Market Dynamics

Pi Network, once a beacon of innovation in the cryptocurrency realm, is currently facing significant market challenges. As its value dropped by 22% last month, and by 17% in a single day, the community is confronted with anxiety and doubt. Trading at a modest $1.16, Pi Network’s valuation starkly contrasts with its previous market capitalization peak of $19.2 billion earlier in the year. So, what are the key factors driving this turbulence, and what does the future hold?

KYC Verification and Its Impact

A significant factor affecting Pi Network’s current situation is the Know Your Customer (KYC) verification process. As the deadline for completion passed, many miners who couldn’t verify their accounts had to abandon their tokens, leading to a sell-off that shook market confidence. This highlights the critical importance of robust KYC processes in maintaining market stability and trust among investors.

The Speculation Surrounding Binance Listing

Market speculation has been rife regarding a potential listing of Pi tokens on Binance, one of the largest cryptocurrency exchanges in the world. Such a listing could significantly boost Pi’s visibility and credibility. However, the silence from Binance has contributed to investor skepticism, underscoring how strategic exchange listings can profoundly impact a cryptocurrency’s trajectory.

Communication and Strategic Clarity

Another challenge for Pi is its opaque communication regarding the Open Mainnet launch. Investor frustration is mounting as the core team fails to provide clear timelines and strategic direction. In contrast, other successful crypto projects maintain transparency, fostering community trust and paving the way for smooth developments. Improving communication could be a pivotal step for Pi Network.

Real-World Adoption in China

Amid the challenges, a bright spot for Pi Network is its growing adoption in China. Businesses, from restaurants to retail venues, are increasingly accepting PI tokens as a mode of payment. This trend not only strengthens Pi’s utility as a digital currency but also potentially stabilizes its market position as it transitions from speculative asset to functional currency.

Market Forecast and Industry Trends

Industry experts predict that if Pi Network can stabilize its price above $1.50, it might rally further, potentially reaching resistance levels at $1.82. However, continued bearish trends could push prices below critical support levels, dipping under $1.20, which would be a precarious position since February.

Actionable Steps for Pi Network

1. Enhance Communication: Improve transparency with a strategic and detailed roadmap for development to regain investor trust.

2. Strengthen KYC Procedures: Simplify the verification process to reduce token abandonment and improve market stability.

3. Expand Exchange Listings: Proactively pursue listings on major exchanges like Binance to improve liquidity and investor confidence.

4. Leverage Real-World Use Cases: Continue expanding adoption in key markets, showcasing practical applications to boost token utility.

5. Monitor Technical Indicators: Investors should closely watch technical signals for potential support and resistance levels to make informed trading decisions.

Conclusion

Pi Network finds itself at a critical juncture. By addressing current issues with clear strategies and transparent communication, it stands a chance to regain investor confidence and maintain its standing as a viable cryptocurrency. In this high-stakes environment, the core team’s actions will significantly influence whether Pi can turn challenges into opportunities.

For further updates on cryptocurrency trends and insights, visit Binance and Cointelegraph.

Quick Tips for Investors

– Stay Informed: Follow trustworthy crypto news outlets for the latest updates on Pi Network.

– Diversify Investments: Avoid putting all funds into one asset to mitigate risk.

– Evaluate Risks: Weigh the potential rewards against the risks involved before making investment decisions.