- The imposition of new trading tariffs has disrupted global financial markets, impacting both cryptocurrencies and stock performances.

- U.S. crypto stocks, including Coinbase and MicroStrategy, have experienced significant declines, reflecting market uncertainty.

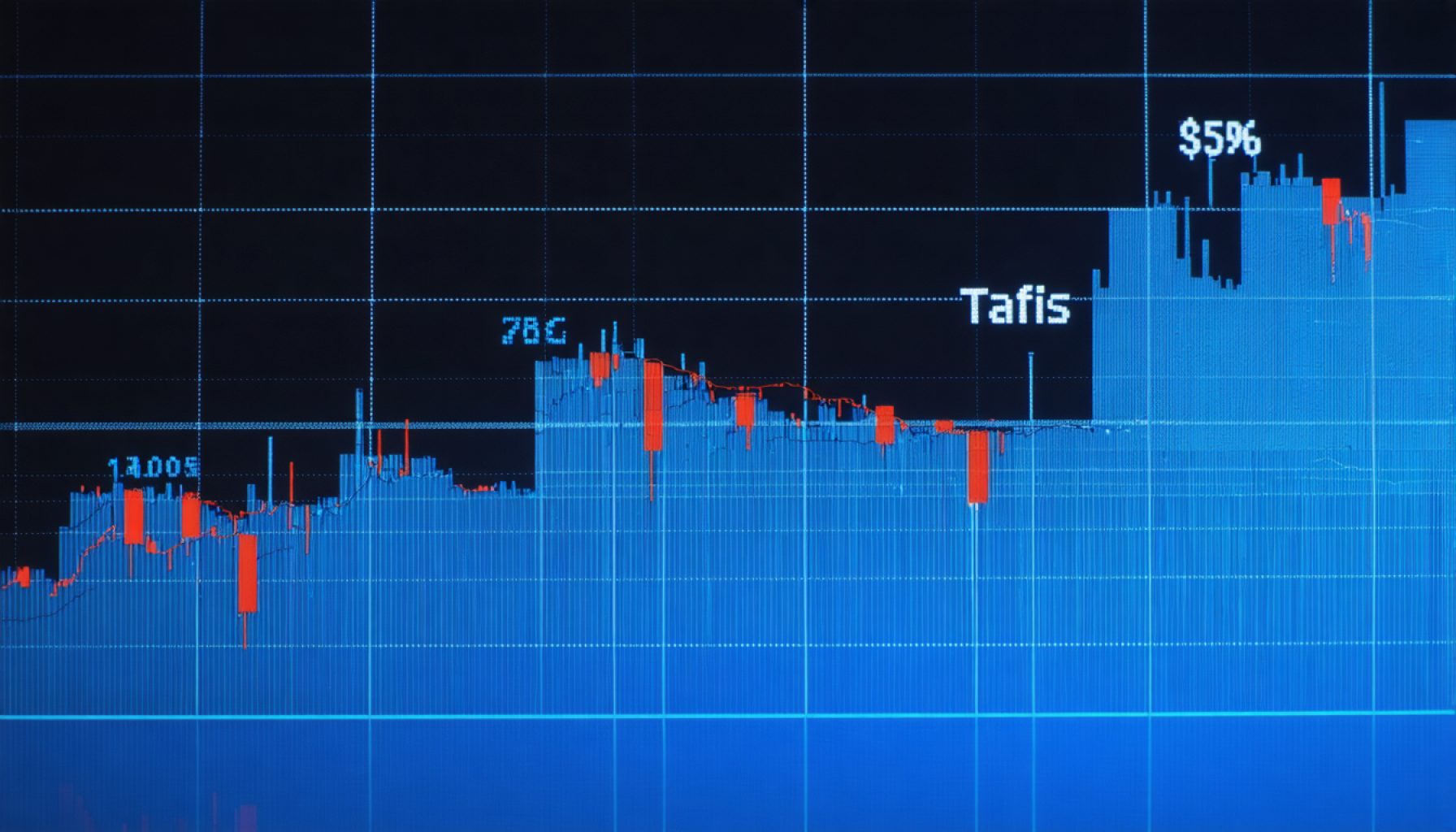

- Bitcoin and Ether prices have fallen, further indicating market volatility and investor caution.

- Despite current challenges, cryptocurrencies continue to embody resilience, thriving on their adaptable and inclusive nature.

- Experts maintain that digital currencies offer a hedge against economic instability, although caution is advised amidst optimism.

- Crypto ETFs are gaining attention as potential investment opportunities, offering diversification to retail investors.

- Adaptability and vigilance are crucial for investors navigating the uncertain crypto landscape, highlighting both risk and opportunity.

A new ripple of uncertainty courses through the financial world as the latest round of trading tariffs sends tremors across global markets. Imaginations run wild and markets tremble as investors grapple with the new policies bringing unexpected challenges. With the sound of a gavel, President Trump’s bold trade maneuver has sparked unforeseen reactions in the heart of cryptocurrency investments.

The early hours of trade painted a grim picture on Wall Street, where U.S. crypto stocks faced a daunting chorus of declines. Market bellwether Coinbase Global saw its shares dip nearly 4%. Even titans like MicroStrategy—known for holding significant reserves of Bitcoin—experienced a 3% slide. The pressure rippled across the board, sending crypto miners like MARA Holdings and Riot Platforms down by 4% and 5%, respectively, as the chill of market tension took hold.

But it’s not just individual companies feeling the squeeze. The very essence of the digital age—the cryptocurrencies themselves—stood affected. Bitcoin, often embraced as a haven in uncertain times, staggered with a 2.3% decrease. Ether echoed this sentiment, plunging 3.3%, leaving investors watching anxiously as funds ebbed and flowed around the virtual coins.

Through all this turbulence, the spirit of adventure that defines the crypto landscape remains unshaken. Since its inception, the realm of digital currencies has thrived on navigating through uncertainties with agility and resolve. While the Trump administration hints at a supportive stance towards crypto, these recent economic waves underscore an investor’s need for relentless vigilance and adaptability.

Some experts highlight crypto’s robust and inclusive architecture as a beacon of hope amidst the chaos. A realm without borders and with a touch of democratic spirit, digital currencies offer investors worldwide a hedge against the fiscal tide. Still, amid this potential refuge, the whispers of caution linger.

As looming economic tempests sculpt new horizons, crypto exchange-traded funds (ETFs) emerge as potential lifeboats for retail investors. With promises of diversification and opportunity, they invite interest from those yearning for a foothold. Yet, these gestures of optimism must contend with the reality of a possibly softening investor flow if the seas become particularly rough.

In the swirl of market turmoil, crypto demonstrates both its vulnerability to global economic currents and its enduring lure for those daring enough to weather the storm. As investors navigate these complex waters, the profound adaptability of cryptocurrencies remains the key takeaway—a narrative not just of volatility, but of resilience and opportunity in equal measure.

The Impact of Trade Tariffs on Cryptocurrency: Navigating Uncertain Waters with Confidence

The global financial landscape has been sent into a state of uncertainty with the announcement of new trade tariffs impacting markets worldwide. This development has particularly affected the cryptocurrency sector, where fluctuations are amplified by investor reactions to shifting economic policies.

Understanding Cryptocurrency Volatility and Resilience

The Impact on Major Players:

– Companies like Coinbase Global and MicroStrategy experienced noticeable declines, with shares falling by 4% and 3% respectively. These drops highlight the interconnectedness between traditional finance and the cryptocurrency market.

– Crypto miners such as MARA Holdings and Riot Platforms witnessed declines of 4% and 5%, further underscoring the sector’s sensitivity to broader economic shifts.

Cryptocurrency Price Movements:

– Bitcoin and Ether, two of the largest digital currencies, saw price declines of 2.3% and 3.3% respectively. These fluctuations serve as reminders of the inherent volatility in the cryptocurrency markets, yet also signal potential buy opportunities for certain investors.

Navigating the Market with Crypto ETFs

Advantages of Crypto ETFs:

– As a diversification tool, crypto exchange-traded funds (ETFs) offer investors exposure to a basket of digital assets, mitigating the risks associated with individual cryptocurrency fluctuations.

– Crypto ETFs provide an accessible entry point for retail investors seeking a managed investment approach without direct exposure to the underlying technical complexities of individual cryptocurrencies.

Challenges and Considerations:

– Despite their promise, crypto ETFs face challenges such as regulatory scrutiny and potential investor hesitancy during uncertain economic periods.

– Investors should assess their risk tolerance and consider the potential for reduced liquidity in volatile market conditions.

Expert Opinions and Market Forecasts

Expert Insights:

– Analysts suggest that while current market conditions are challenging, the structural integrity and global adoption of cryptocurrencies present long-term growth opportunities.

– The resilience of blockchain technology and its decentralized nature remain attractive, particularly as traditional financial markets experience volatility.

Future Trends:

– The ongoing evolution of cryptocurrencies, including advancements in blockchain technology and increased institutional adoption, point to a potentially stabilizing factor in the industry.

Actionable Recommendations for Investors

Key Steps for Investors:

1. Stay Informed: Regularly follow market news and expert analyses to make well-informed investment decisions.

2. Diversify Holdings: Consider a balanced portfolio encompassing a mix of cryptocurrencies and other asset classes.

3. Assess Risk Tolerance: Evaluate your capacity to endure market volatility without compromising short-term financial security.

4. Explore ETFs: For those seeking managed exposure, research and consider crypto ETFs that align with your investment objectives.

In conclusion, while the current trade tariffs introduce uncertainty into the financial markets, the cryptocurrency landscape remains a field of both risk and opportunity. By leveraging informed strategies and maintaining a watchful eye on market developments, investors can navigate these turbulent times with resilience and adaptability.

For more insights and latest updates on cryptocurrencies, visit CoinDesk.