- Pi Coin’s value surged by 28% in 24 hours, reaching $1.73 with a market cap of $11.8 billion and trading volume of $744 million.

- Speculation around a potential Pi Network Finance listing and widespread community support could further boost Pi Coin’s value.

- Pi Network’s sixth anniversary on March 14 is critical, with users needing to complete KYC verification and migrate to the Mainnet Pi platform.

- Technical issues in the KYC and migration process, alongside potential market dilution, pose challenges to Pi Coin’s upward momentum.

- Despite concerns, breaking the $1.70 level strengthens Pi Coin’s prospect of surpassing $2, with potential support from listings like Binance.

- Successful migration and real-world adoption by businesses could stabilize Pi Coin’s value and increase confidence among mainstream investors.

- Bullish trading charts and successful resolution of current challenges could position Pi Coin among the elite in the cryptocurrency domain.

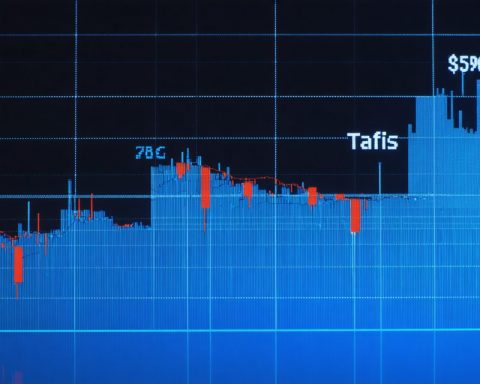

Beneath the serene surface of cryptocurrency markets, a tempest named Pi Coin is brewing. In an electrifying 24-hour blitz, Pi Coin’s value spiraled upward by 28%, leaping from $1.35 to $1.73. This surge catapulted its market capitalization to a breathtaking $11.8 billion, buoyed by a fervent trading volume spike of 65%, reaching a formidable $744 million. While yet to reclaim its apex of $2.98 from early 2025, market whispers suggest that Pi Coin is poised for even greater heights.

The ongoing buzz swirling around Pi Network is largely fueled by whispers of an impending Pi Network Finance listing. An overwhelming 86% of the Pi faithful have given their nod to a potential exchange listing. Should this speculation materialize into reality, it could supercharge Pi Coin’s value, igniting fervor across the crypto landscape.

As the calendar inches toward March 14, Pi Network enthusiasts brace for a pivotal event—the network’s sixth anniversary. By this deadline, users must complete KYC verification and migrate their holdings to the Mainnet Pi platform or risk forfeiting much of their pool. This maneuver will cement their stake in the rapidly swelling Pi universe, transitioning their assets from the Testnet to the robust Mainnet ecosystem.

Yet, clouds mar the horizon. Community members report technical glitches in the KYC and migration process, compounded by fears of a flood of Pi tokens diluting the market. With only 7.15 billion Pi Coins circulating out of a staggering 100 billion total supply, concerns about overextension threaten to temper this upward momentum.

Nonetheless, market pundits remain optimistic. Breaking the $1.70 threshold lays a foundation for Pi Coin to potentially breach the $1.80 barrier and eye the tantalizing $2 mark. The bold whispers say that if adoption continues apace and a Binance listing comes through, Pi Coin’s journey to $3 could very well be on the cards.

Critical to this success will be the Pi Network itself. By resolving technical hitches and facilitating a smooth migration, Pi could not only stabilize its value but also bolster confidence among mainstream investors. The more businesses, like Florida’s Zito Realty, embrace Pi Coin as a valid transaction medium, the stronger its foothold becomes in real-world utility.

The trajectory of Pi Coin is elegantly mapped on trading charts, with bullish signals suggesting forward momentum. Yet, only with deft handling of current challenges—combining market sentiment with innovations like Binance’s co-governance—will Pi Coin secure its place among crypto’s elite, perhaps even achieving a new all-time high.

As the clock ticks toward the crucial March deadline, the world watches to see whether Pi Coin will solidify its foothold as a digital currency warrior, poised to reshape its narrative in the ever-evolving realm of crypto finance. The potential is compelling; the anticipation is electric.

Pi Coin: Is It the Next Big Boom or a Risky Gamble in the Crypto Market?

Understanding Pi Coin’s Rise and Potential

Pi Coin has captivated the crypto world with its sudden surge in value, increasing 28% in 24 hours and reaching a market capitalization of $11.8 billion. This growth is largely attributed to speculation about Pi Network Finance’s potential listing and a significant increase in trading volume.

Key Factors Driving Pi Coin’s Prospects

1. Impending Exchange Listing: Speculation about a possible listing on major exchanges like Binance has fueled optimism. An 86% approval rate among community members for exchange listing could propel Pi Coin’s value significantly.

2. Mainnet Migration and KYC Verification: With the Pi Network’s sixth anniversary approaching, users must complete their Know Your Customer (KYC) verification and transfer assets to the Mainnet Pi platform. This transition from the Testnet is crucial for securing stakes in the ecosystem and increasing the coin’s utility.

3. Community Concerns and Challenges: Despite enthusiasm, there are reports of technical issues in the KYC and migration processes. Additionally, only 7.15 billion of the total 100 billion Pi Coins are currently circulating, raising concerns about market oversaturation.

How-To Steps: Navigating Pi Coin Investments

1. Monitor Exchange Listings: Keep an eye on announcements regarding potential listings on exchanges like Binance. These listings can drive substantial price movements.

2. Complete KYC and Migrate Assets: Ensure KYC verification and asset migration to the Mainnet platform before the March 14 deadline to avoid losing virtual assets.

3. Stay Informed: Follow updates from credible sources within the Pi Network community to understand ongoing developments and technical challenges.

Real-World Use Cases

Businesses like Florida’s Zito Realty accepting Pi Coin for transactions highlight its potential real-world utility. The more companies embrace Pi Coin, the stronger its legitimacy and value in everyday commerce.

Market Forecasts & Industry Trends

Analysts suggest Pi Coin breaking the $1.70 threshold could pave the way to the $1.80 mark, with a possible reach to $3 if mainstream adoption and exchange listings continue. This prediction hinges on the network’s capacity to handle technical challenges smoothly.

Industry Controversies and Limitations

Concerns about the high total supply risking inflation and the potential market flood of Pi tokens could impact future valuations. Addressing these issues is crucial for preventing market instability.

Top Pressing Questions

– Why should I invest in Pi Coin?: Potential high returns due to upcoming exchange listings and increased real-world use cases.

– What are the risks involved?: Overextension of supply, unsolved technical issues, and market volatility present risks.

Pros & Cons Overview

Pros:

– High growth potential

– Strong community backing

– Increasing real-world usage

Cons:

– Technical challenges in migration

– Concerns over market supply and inflation

– Dependence on speculative events like exchange listings

Conclusion: Actionable Recommendations

– Diversify Investments: Don’t put all your capital into Pi Coin. Diversification helps mitigate risks associated with volatile crypto markets.

– Join Community Forums: Engage with reliable Pi Network communities for insights on technical updates and market sentiment.

– Regularly Review Portfolio: Keep adjusting based on market trends and personal financial goals.

Explore more on the world of cryptocurrencies and stay updated on market trends at CoinTelegraph and CoinDesk.